31+ How much mortgage i qualify for

We calculated the amount of money youll need for a 450k. A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total annual income.

Amazon Com Autel Maxipro Mp808ts Scanner 2022 2 Years Free Update From Mp808 Ds808k Mp808k Mp808bt Mk808ts Tpms Diagnoses As Maxisys Ms906ts 31 Special Functions Ecu Coding Bi Directional Scan Tool Automotive

For those who qualify under the income caps the White House plan would erase 10000 of debt from their federal student loans.

. Those with Pell grants roughly 27 million. Many lenders look for a down payment of at least 20 though you can find no-down payment mortgages or lenders that will accept a down payment as low as 3. Borrow From Your Home And Enjoy The Retirement You Deserve With A Reverse Mortgage.

Take Advantage And Lock In A Great Rate. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. The current average interest rate on a 51 ARM is 450.

Compare Find The Lowest Rate. Total monthly debt payment. To qualify for a loan insured by the Federal Housing Administration your front-end ratio cannot exceed 31 percent.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Learn More About Mortgage Preapproval. 2 days agoAnd theres one question in particular thats top of mind for borrowers.

So if your income is 4000 per. Dont Wait Take Advantage of Todays Historically Low Rates While You Still Can. When can borrowers who qualify for 10000 or 20000 in student loan forgiveness expect their debt to.

Its pretty simple your debt forgiveness is limited to how much you still owe. Suppose youre getting a 30-year fixed mortgage. Typically lenders cap the mortgage at 28 percent of your monthly income.

Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Or Refinance to Take Cash Out. You can figure 31 percent of your gross monthly income to determine the.

Generally figures like 5 10 or 20 are used. How much income do you need to buy a 500000 house. Ad You Could be Saving Hundreds by Refinancing Your Mortgage.

Get Instantly Matched With Your Ideal Home Loan Lender. Browse Information at NerdWallet. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Find Out How Much House You Can Afford With Our Easy-To-Use Calculator. Compare Top Lenders Today. 1 day ago51 Adjustable-Rate Mortgage Rates.

For example if youre a Pell Grant recipient making less than 125000 and you have a balance of. These monthly expenses include property taxes PMI association. A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

Of course the lower the better as you will be more likely to be able to keep up with the payments. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford. To bypass private mortgage insurance you make a 20 down of 70000.

This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI. Youre looking to buy a house worth 350000 at 4 APR. The more you pay in a.

Ad Find The Best Place To Get a Home Loan Today By Comparing The Best Lenders Out There. Using the example figures. If you lock in.

The 52-week low was 409 compared to a 52-week high of 450. How much do I need to make for a 250000 house. Ad Advanced Options Include Mortgage Loan Type Mortgage Interest Rate PMI And More.

Total monthly PMI payment 5 a year on - loan since your down payment was - -. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Table comparing the loan amount for both the conservative and the aggressive.

435 20 votes To finance a 450k mortgage youll need to earn roughly 135000 140000 each year. Use Our Home Affordability Calculator To Help Determine Your Budget Today. Once the lender has completed a preliminary review they generally provide a pre-qualification letter that states how much mortgage you qualify for.

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your. How Much Income To Qualify For 400 000 Mortgage Lets Start With The Basics Gross annual household income is the total income before deductions for all. This means your monthly payments.

Our Mortgage Qualification Calculator uses your monthly gross income and debt payments to determine what size mortgage you qualify for based on current interest rates and the length of. With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. You can plug these numbers plus.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad See If You Qualify For Reverse Mortgage Loans. Were not including any.

Your total monthly payment will fall somewhere slightly. Lender Mortgage Rates Have Been At Historic Lows.

Should You Skip Mortgage Payments If You Don T Have To

How To Save Money Fast 3 Tricks Above 1000 Hr

April 2016 Traffic And Income Report Income Reports Make Money Blogging Blog Income

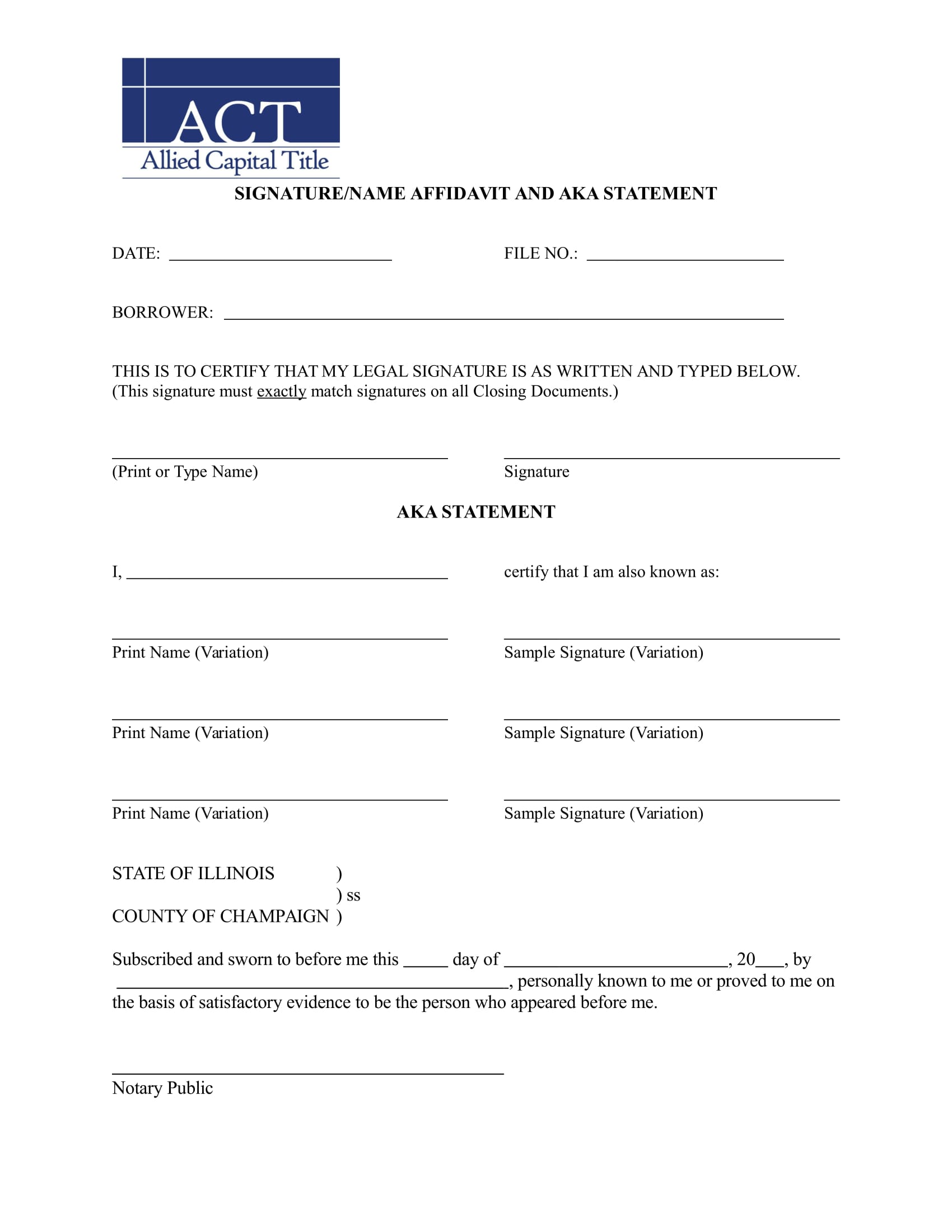

31 Statement Forms In Ms Word Pdf Excel

Img008 Jpg

Axos Financial Inc Free Writing Prospectus Fwp

Axos Financial Inc Free Writing Prospectus Fwp

Deployment Checklist Deployment Checklist Military Deployment

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

Pin On Bible Study

31 Cottonwood Trl Deming Nm 88030 Realtor Com

Pin On Bible Study

Free 31 Sample Daily Log Templates In Pdf Ms Word With Regard To Pool Maintenance Log Template Ms Word Pool Maintenance Templates

How To Save Money Fast 3 Tricks Above 1000 Hr

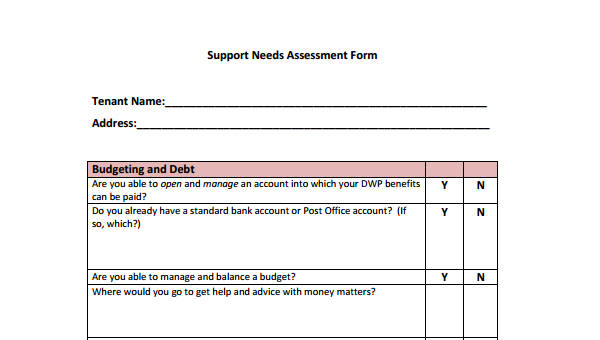

Free 31 Needs Assessment Forms In Pdf Excel Ms Word

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

How To Save Money Fast 3 Tricks Above 1000 Hr