57+ can you write off mortgage interest on a rental property

Web Mortgage balances for rental property usually equal several hundred thousands of dollars. Ad Developed by Lawyers.

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

For example if it cost you 3000 to refinance your 30-year.

. Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Lenders generally require a 20 to 25 percent down payment to purchase a one- to four.

Web If you rent your entire property as an Airbnb you can only deduct mortgage interest based on how often the property is rented out. Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property. Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes.

Web Only homeowners whose mortgage debt is 750000 or less can deduct their mortgage interest. Instead these expenses are added to your basis in the. Create Your Satisfaction of Mortgage.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web The costs associated with obtaining a mortgage on rental property are amortized spread out over the life of the loan. For example if you.

Web Should that owner have a rental income of 36000 taking a 16000 deduction for the mortgage interest reduces their taxable rental income to 20000a. Many other settlement fees and. Note that if any portion of the loan proceeds are used for.

LawDepot Has You Covered with a Wide Variety of Legal Documents. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. Web If the loan is secured by your rental property the mortgage interest is reported as a Rental Expense.

If you are married filing separately you can only deduct. Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat.

Rim Country Review Real Estate More September 22 By Rim Country Review Magazine Issuu

57 Catchy Mortgage Slogans Taglines Slogans Hub

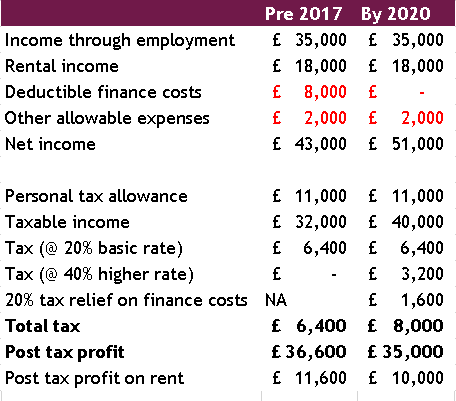

Buy To Let Tax Relief Moneysupermarket

How Much Do I Need In My Pension To Retire At 55

Landlord Tax Changes Come Into Effect April 2017

What Is The Mortgage Interest Deduction And How Does It Work Thestreet

Deduction Of Mortgage Interest On Rental Property

Is Your Mortgage Considered An Expense For Rental Property

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Property For Sale In Nad Al Sheba Dubai Buy 57 Property In Nad Al Sheba Dubai

57 Catchy Mortgage Slogans Taglines Slogans Hub

Vacation Home Rentals And The Tcja Journal Of Accountancy

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

44 Adobe Canyon Rd Patagonia Az 85624 Realtor Com

Pdf Rethinking Property Tax Incentives For Business Rethinking Property Tax Incentives For Business

9753 W Crookton Rd Ash Fork Az 86320 Realtor Com

Can You Claim Rental Mortgage Interest As An Itemized Deduction