Solo 401k profit sharing calculation

Click on the link below enter requested info below and click the. 20500 in 2022 19500 in 2020 and 2021 or 27000 in 2022 26000 in 2020 and 2021 if age 50 or over.

Solo 401k Contribution Limits And Types

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

. Plus Employer nonelective contributions up to. Individuals may contribute up to 19500 for 2021 and up to 20500 for 2022. Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008.

If Kyles W-2 income were 275000 he could still make the 19500 employee deferral and 6500 catch up. Maximum Solo 401 k contribution maximum profit sharing contribution maximum salary deferral NOTE. I am a sole proprietor and have a Solo 401k retirement account.

Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into an Individual 401k SEP IRA Defined Benefit Plan or. 57000 63500 including catch-up contributions for 2020. Once a solo 401 k is set up with profit sharing a business owner can put up to 20500 a year into the account plus up to 25 of net earnings up to a total of 61000.

A Solo 401 k. Solo 401k Contribution Calculator. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer.

This is the percent of your salary matched by your employer in the form of a profit share. Note that Kyles profit sharing limit is based on 75000 in W-2 compensation. If permitted by the 401 k plan participants age 50 or over at the end of the.

Employers may contribute up to 25 of compensation up to a maximum of 58000 in 2021 and 61000 for. The maximum Solo 401 k contribution for 2022 may not. In 2020 100 of net adjusted business profits income up to the maximum of 19500 or 26000 if age 50 or older can be contributed in salary deferrals into a Solo 401k 2019 limits are.

Specifically you are allowed to make. Maximum Solo 401 k contribution maximum profit sharing contribution maximum salary deferral NOTE. Solo 401k Contribution Calculator allows you to calculate the maximum amount you can contribute to your plan.

The maximum Solo 401 k contribution for 2021 may not. For example if you have an annual salary of 25000 and the employer profit share is 3 your. This type of retirement account allows for employee elective deferrals and employer profit sharing.

100 of the participants compensation or 58000 64500 including catch-up contributions for 2021. The Solo 401k Profit Sharing Contribution is also known as the Employer Contribution. An employee contribution of for An employer.

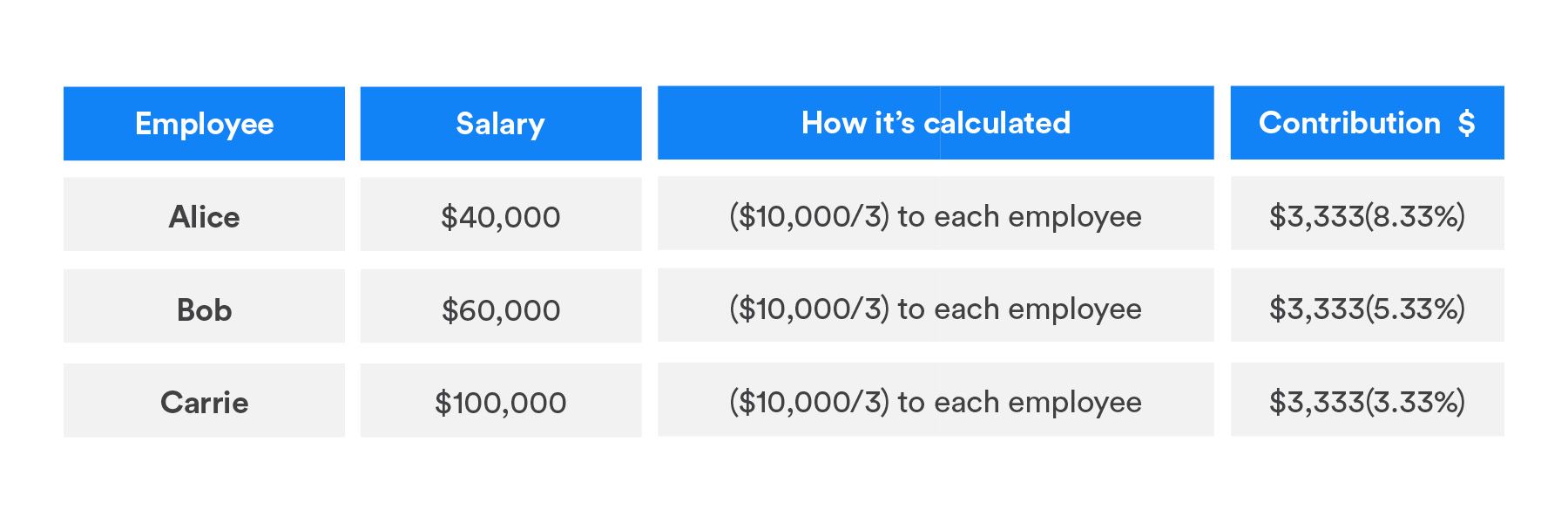

You calculate each eligible employees contribution by dividing the profit pool by the number of employees who are eligible for your companys 401k plan.

What Is A True Up Matching Contribution

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

How Much Can I Contribute To My Self Employed 401k Plan

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Planner Early Retirement

Solo 401k Contribution Limits And Types

Solo 401k Contribution For Partnership And Compensation

Solo 401k Contribution Limits And Types

Are Discretionary Matching Contributions Becoming A Little Less Discretionary

Solo 401k Contribution Limits And Types

Solo 401k Contribution And Deduction

Column Two Rival Experts Agree 401 K Plans Haven T Helped You Save Enough For Retirement How To Plan Changing Jobs Retirement Accounts

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

401 K Profit Sharing Plans How They Work For Everyone

Solo 401k Contribution Calculator Solo 401k

How To Calculate Solo 401k Contributions Self Employed Retirement Plan Youtube

D Dyosviq74 Um