21+ 2020 Capital Loss Carryover Worksheet

If you dont have a capital loss carryover to next year then skip this line and go to line 2j. Web A statement that you are applying or applied section 3011 2 or 3 of Rev.

Tax Loss Carryforward What Is It And How Does It Work Sofi

Capital gain from children under age 19 or students under age 24 included on the parents or childs federal tax return and reported on the California tax return by the opposite taxpayer.

. Web Self-employed tax payments deferred in 2020. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Web Depreciation is a capital expense.

2021-48 and for what taxable year 2020 or 2021 as applicable. You may be able to treat the gain or loss as a capital gain or loss. Or b if the amount on your 2021 Form 1040 or 1040-SR line 15 or your 2021 Form 1040-NR line 15 if applicable would be less than zero.

Most refunds are issued in less than 21 days. Web References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and the California Revenue and Taxation Code RTC. For more information see chapter 4 of Pub.

NW IR-6526 Washington DC 20224. Net Operating Loss Suspension For taxable years beginning on or after January 1 2020 and before January 1 2023 California has suspended the net operating loss NOL carryover. An example is gain or loss from the disposition of nondepreciable personal property used in a trade or business activity of the partnership.

To report your share of a gain or loss from a partnership S corporation estate or trust. We welcome your comments about this publication and your suggestions for future editions. Web Net short-term capital gain loss and net long-term capital gain loss from Schedule D Form 1065 that isnt portfolio income.

Web To report a capital loss carryover from the previous tax year to the current tax year. Web The carryover of disallowed deduction from 2020 is the amount of section 179 property if any you elected to expense in previous years that was not allowed as a deduction because of the business income limitation. Complete the State and Local General Sales Tax Deduction Worksheet or use the Sales Tax Deduction Calculator at IRS.

These gains and losses are called section 1231 gains and losses. If you use the proceeds of a loan for more. 1001 for more information about.

In general the NOL deduction for tax years beginning after December 31 2020 cannot exceed the sum of the NOLs carried to the year from tax years beginning before January 1 2018 plus the lesser of i the NOLs carried to the year from tax years beginning after December 31 2017 or ii 80 of the excess if any of taxable. Web Limitations on Losses Deductions and Credits. Actual expenses or the standard mileage rate.

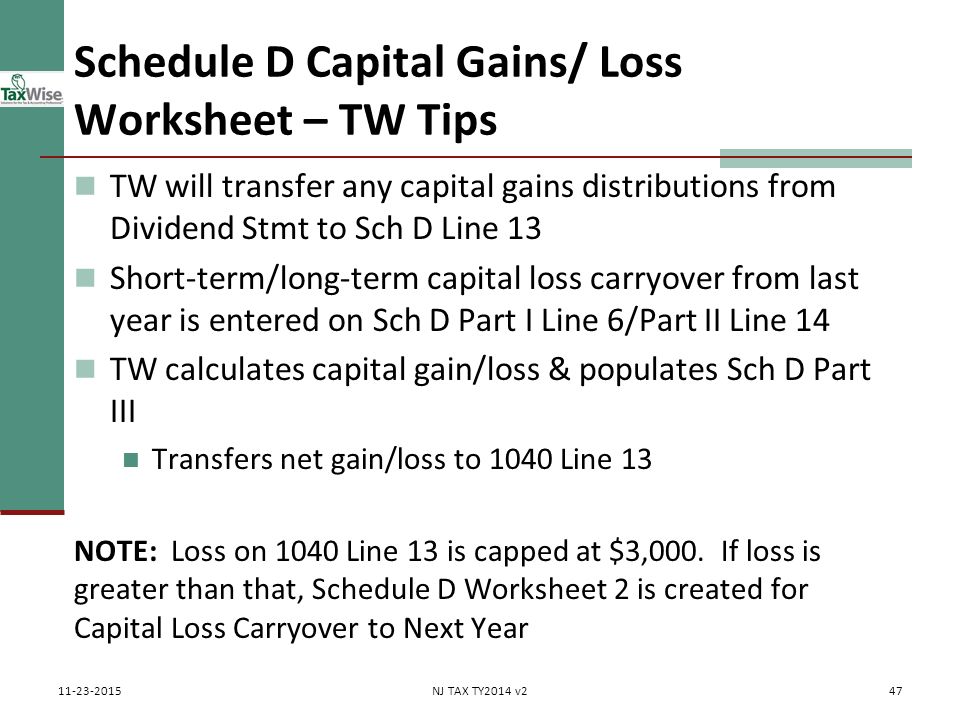

Web If there is a loss on your 2020 Schedule D line 21 add that loss as a positive amount and your 2020 capital loss carryover to 2021. If you filed Form 4562 for 2020 enter the amount from line 13 of your 2020 Form 4562. Report total net short-term gain loss on Schedule D Form 1040 line 5.

There is a new Schedule B Form 1116 which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. These limitations and the order in which you must apply them are as follows. Web NOL deduction limitation.

An example is gain or loss from the disposition of nondepreciable personal property used in a trade or business activity of the corporation. FICA tax and Federal Unemployment Tax Act FUTA tax and must be reported. As a result all partnerships must report business interest expense to.

Report total net short-term gain loss on Schedule D Form 1040 line 5. Web On the S portions Form 8960 worksheet. Web Capital loss carryover from your 2019 California Schedule D 540NR.

116-94 added section 45T. 1001 for more information about. If you had an NOL for 2020 enter it as a positive amount.

See IRS Notice 2014-21 Rev. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Web Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

To do this use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed whichever is appropriate for your plans. A QOF was extended until June 30 2021 if the last day of the 180-day investment period falls on or after April 1. For more information get form FTB 3803.

Web The Further Consolidated Appropriations Act 2020 PL. Web Net short-term capital gain loss and net long-term capital gain loss from Schedule D Form 1120-S that isnt portfolio income. Web Capital loss carryover from your 2020 California Schedule D 540NR.

Subtract from that sum the amount of the loss on your 2020 Schedule D line 16 and enter the result. Otherwise enter the lesser of i1 or i2 as a negative amount. See the Instructions for.

Web A weight-loss program as treatment for a specific disease including obesity diagnosed by a doctor. It includes income from licensing the use of property other than goodwill. But it doesnt include capital gains.

This new schedule replaces the previous attachment requirement for Form 1116 Part III line 10. Web You have an AMT capital loss carryover from 2022 to 2023 of 62000 of which 22000 is short term and 40000 is long term. For more information get form FTB 3803.

Web For example if you sold a stock for a 10000 profit this year and sold another at a 4000 loss youll be taxed on capital gains of 6000. Web New Schedule B Form 1116 Foreign Tax Carryover Reconciliation Schedule. On Schedule 1 Form 1040 line 21 as explained in Pub.

In 2020 the regular income tax NOLs from 20162019 have caused the taxpayers AGI 0 to fall below the statutory threshold. If you have no other Form 8949 or Schedule D transactions for 2023 your adjustment reported on your 2023 Form 6251 would be limited to 3000 the amount of your capital loss limitation for 2023. Web Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023.

Web Comments and suggestions. Capital gain from children under age 19 or students under age 24 included on the parents or childs federal tax return and reported on the California tax return by the opposite taxpayer. 1001 for more information about.

It is the mechanism for recovering your cost in an income-producing property and must be taken over the expected life of the property. Capital gain from children under age 19 or students under age 24 included on the parents or childs federal tax return and reported on the California tax return by the opposite taxpayer. For 2020 the standard mileage rate for business use is 575 cents a mile.

Web Use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2021 Schedule D line 16. For more information get form FTB 3803. For more information about ordinary and capital gains and losses see chapters 2 and 3 of.

The basis limitations Form 7203 the at-risk limitations Form 6198 the passive activity loss limitations Form 8582 and the. The amount of tax-exempt income from forgiveness of the PPP Loan that you are treating as received or accrued and for what taxable year 2020 or 2021. There are potential limitations on corporate losses that you can deduct on your return.

Web Capital loss carryover from your 2019 California Schedule D 540. Web Regulations section 1163j-6h created a new section 704d loss class for business interest expense effective for tax years beginning after November 12 2020.

Managing S Corporation At Risk Loss Limitations

Schedule D Capital Loss Carryover Scheduled

Basic Schedule D Instructions H R Block

Schedule D 541 California Franchise Tax Board

Carryover Short Term Capital Losses Confusion From Freetaxusa My Losses In 2020 Were 3339 But Software Says My Carryover Is Only 935 R Tax

State Capital Loss Carry Over

Solved Capital Loss Carryover What Goes In The Regular Tax Box

Solved Why Didn T Turbotax Import My Capital Loss Carryover

Capital Loss Carryover Fill Out Sign Online Dochub

How To Minimize Portfolio Taxes

Irs Schedule D Instructions

Fill Free Fillable Form 1041 Schedule D Capital Gains And Losses Pdf Form

How To Deduct Stock Losses From Your Taxes Bankrate

What Is Capital Loss Carryover Fincash

Capital Loss Carryover On Your Taxes Youtube

1040 Net Operating Loss Faqs

Capital Gains Losses Including Sale Of Home Ppt Download